Retirement Now Newsletter December 2nd, 2021

I came across a very good article on safe withdrawal rates, written by none other than Bill Bengen, the man who first brought us the study on the 4% safe withdrawal rate back in the 90’s.

He has since revised upward his safe withdrawal rate to 4.7%.

There are different positions within the retirement advisory world on what exactly the safe withdrawal rate should be. Some positions more conservative than others. Some even say there is no “safe” withdrawal rate. There probably will never be an agreement that everyone is comfortable with.

It’s like the debate between immersion vs sprinkling baptism… only with retirement researchers hashing it out.

In the article he talks about another safe withdrawal estimate put out by a different study that recently said 3.3% is the safe amount.

The reason for the lower withdrawal amount is that this other study is assuming a much lower rate of return on investments going forward due to the high valuations we currently see in the market.

Bengen then goes on to explain why he assumes a higher rate of return. And a lot of his reasoning hinges on two things that compliment each other:

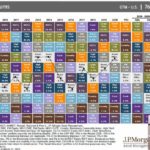

One, investing in multiple assets that are not correlated

Two, rebalancing the portfolio.

Pretty simple concepts, yet very powerful. And I’d dare say that most non-institutional investors probably do not follow these principles to a tee.

By using non-correlated assets, all that means is that they don’t typically move in the same direction at the same time. When one is up the other may be down.

And when this happens he can rebalance the portfolio back into the original allocation percentages, which means selling some of the positions that have gone higher, and buyer some of the positions that have gone lower.

In short, that is buying low and selling high in action.

And over time that has an impact. Which is one reason he projects a higher long-term growth rate when making his calculations for estimated safe withdrawal percentages.

Now there’s more to his reasoning, specifically around the idea of a concept called mean reversion, that you can read in the article if that interests you.

But what I find so helpful about this is the simplicity of investing this way. It’s the way of picking an asset allocation and simply maintaining it over time by making small buys/sells through rebalancing. It doesn’t involve complicated formulas, trying to guess the market, trying to time the market, following the gurus on investment tv shows touting the next hot stock, trying to predict what crypto is going to do, asking Miss Cleo to read your future, or any other complicated strategies that may or may not even work in the first place.

It’s simple and understandable.

Yet at the same time can be difficult for many investors to implement. It requires a certain level of vigilance, watching how your overall allocations are doing. Making the minor rebalancing adjustments over time. It’s not set it and forget it like the chicken rotisserie. It also requires making the tough decision to sell a position that is doing well to buy a position that is doing poorly… at least temporarily.

It’s simple, but at the same time hard.

Anyways, I hope that is a help to you as you plan for your retirement and how to invest your money to help make it last the rest of your life and support your spending needs.

Because if you have concerns about outliving your money I invite you to reach out to me and we can have a talk and explore some possible solutions and strategies. Just click here.